We know that many of your clients are relying on term deposits for their defensive exposure but with rates averaging little more than 2%, they are barely keeping pace with inflation. With these current rates, investors are looking for better returns and use of their cash in their holdings.

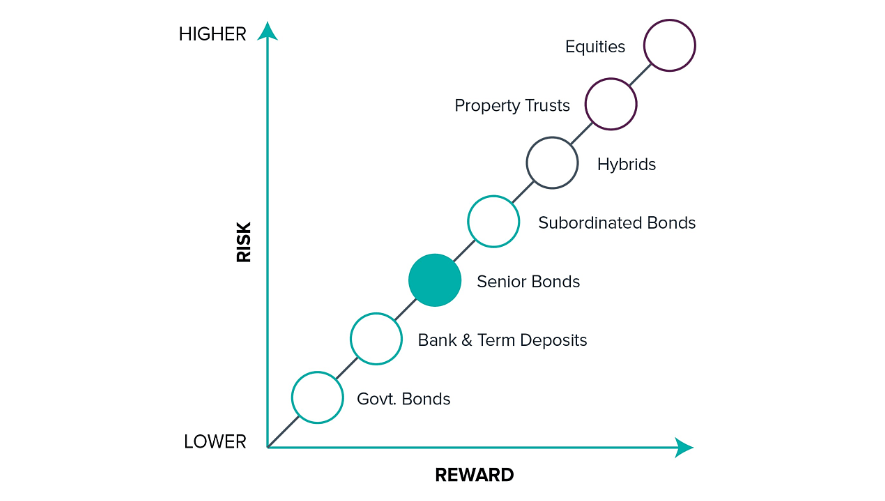

Fixed-income assets, such as bonds, are defensive and can play an anchoring role in a diversified portfolio. They are negatively correlated with shares and generally have lower risk. They also provide a steady and predictable source of income with regular interest payments.

Until recently, corporate bonds could only be accessed via a fixed-income fund or ETF; you couldn’t pick and choose which bonds you wanted to buy in the same way you could with shares.

Exchange-traded bond units (XTBs) are a new product which gives access to fixed-income to all investors. They bring together the income and capital stability of corporate bonds with the transparency and liquidity of the ASX market.

What are XTBs?

With XTBs, your clients can get the returns of individual corporate bonds and the exposure to a specific underlying corporate bond of an ASX 100 company (e.g. Telstra, Westpac, BHP Billiton).

The performance of each XTB closely follows their individual bond counterpart in the wholesale market with the same maturity date and coupon payment frequency as its corporate bond. For example, a three-year corporate bond with a coupon of 5% translates to a three-year XTB with a coupon of 5%.

Importantly, if your clients invest in XTBs, they will receive 100% of coupon payments, as well as the face value at maturity.

While many corporate bonds have a fixed coupon, others have floating-rate coupons pegged to an industry benchmark with a fixed margin above that. For example, a floating-rate note that tracks the Bank Bill Swap Rate (BBSW) and offers investors 0.75% above this rate, would have a coupon referred to as BBSW + 0.75%. This flows through to the relevant XTB.

Why corporate bonds?

Corporate bonds share many characteristics with other types of bonds. The main differentiator is that they are issued by companies rather than governments or statutory bodies.

A bond is basically an IOU, with the investor returns determined by two factors:

The face value of the bond, which is repaid when the bond matures

The coupon or interest payments made over the life of the bond

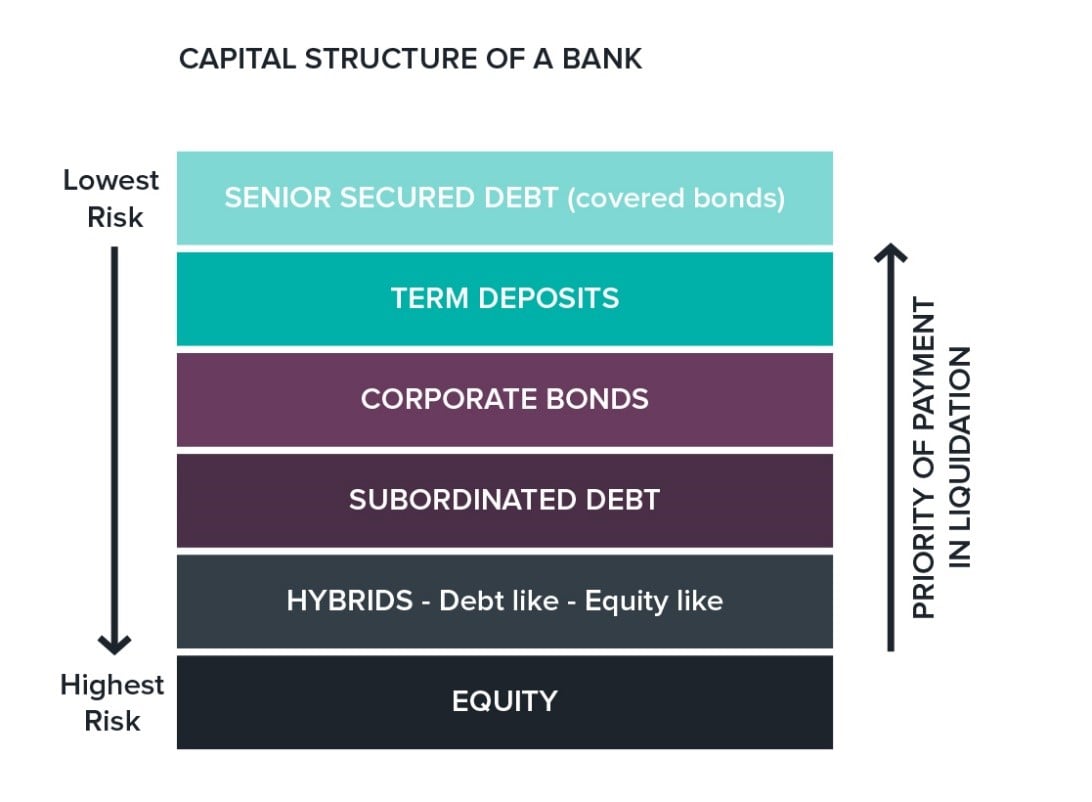

When investing in a company it is important to understand where your clients' investment sits in its capital structure.

Figure 1 below shows the hypothetical corporate structure of a bank. As corporate bonds are lower risk than hybrids and equities, bondholders would be repaid before shareholders in the event of a default.

The capital ranking of securities also indicates their price stability. Corporate bond prices/yields are generally far less volatile than securities ranked below them in the structure, such as equities and hybrids.

How do XTBs work?

The yield and price of each XTB reflects the yield and price of the underlying bond, after fees and expenses. For fixed-rate XTBs, the fees are 0.4% of the face value each year for the life of the bond, and 0.2% per annum for floating-rate XTBs.

The impact of the XTB fee is to lower the yield of the XTB compared with the bond. A corporate bond trading in the wholesale market at a yield of 4.8% becomes an XTB trading on ASX at about 4.4%.

Another positive attribute of the XTB is its parcel size. You can allocate as little as $500 to each XTB selected. This gives you control to build a corporate bond portfolio to meet your specific investment, income and objectives.

The Cash Flow tool is a great way of seeing the cash flow your clients will receive from their chosen XTBs allowing you to ensure their portfolio meets their income needs.

Once your clients are ready to trade, you do this in the same way as all other trades – via the Bell Potter Online order pad. Transactions are settled through CHESS and each XTB is listed on their CHESS account.

There are currently close to 50 XTBs available (including a mix of fixed and floating) across a broad range of larger ASX listed companies, covering the majority of key industry sectors.

Benefits of investing in XTBs

XTBs over corporate bonds are capital stable with predictable income-generation. They can deliver superior returns to Terms Deposits without the price volatility associated with shares and hybrids. In addition:

Corporate bonds mature, at which point your clients receive the face value of their investment, having already received coupon payments for the duration of the investment,

Fixed-income securities are usually negatively correlated to shares and property, so they provide diversification benefits to your clients' investment portfolio,

With ASX transparency you can monitor their value on an ongoing basis,

XTBs are liquid investments so you can buy and sell on ASX at any time, just like shares. Unlike Term Deposits, there are no penalties for selling out before the maturity date.

Next steps

- Visit our XTB page to find out more about how XTBs can help make your clients' cash work harder for them

- Compare the 4 Model Portfolios available (High Yield, Maturity Ladder, Concentrated High Yield and Cash Plus) and select the one that best meets your clients' needs

- Check the income generated from the selected Model Portfolio with the Cash Flow Tool

- Once you know which XTBs to select, simply place your order via the Bell Potter Online Order Pad

_800_533.jpg)