Market wraps 11th February 2026

Morning Bell - Max Lo Certo

Starting over in the US, Wall Street saw a mixed trading session overnight, as the S&P500 and Nasdaq slipped 0.2% and 0.6% respectively, while the Dow Jones added 0.1%, at one point in the day trading at its 3rd all time high in the last 3 days. The market was weighed down by financial stocks, which took a hit after tech platform Altruist officially launched their new AI-powered tax planning tool. Investors are likely to rotate to areas which are most protected from being impacted by the emerging prevalence of AI.

What to watch today:

- The ASX200 is expected to rise at the open today, with the SPI futures indicating an increase of 0.3%

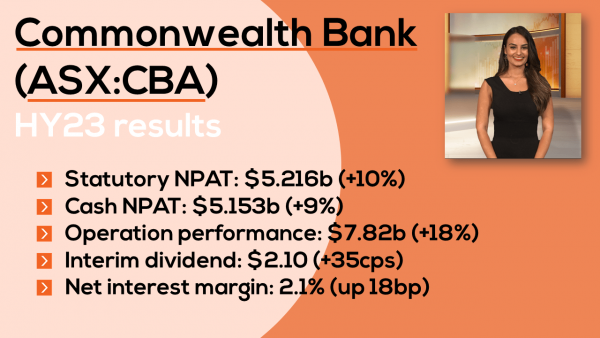

- A big morning in reporting season as Australia’s biggest bank Commonwealth Bank (ASX:CBA) announced their cash profit has increased 5% to $5.4 billion in the half year ending 31 December, and that they will pay a dividend of $2.35 per share.

- Although not released at the time of recording, keep an eye on other major results including AGL Energy (ASX:AGL), Evolution Mining, and James Hardie Industries (ASX:JHX), which are all due to be released this morning. You can stay up to date with results as they come out via Bell Direct’s reporting season page

- Pharmaceutical giant CSL (ASX:CSL) also announced their results, reporting total revenue down 4% to $8.3 billion, Adjusted Net profit after tax of $1.9b, which is a 7% drop, and a reported NPA of $0.4 billion, which represents an 81% drop from last results. These results come in a day after it was announced that they would be dumping chief executive Paul McKenzie, extending the volatile period for the blue chip stock.

- In Bell Potter’s latest research, the broker has maintained its Buy rating, however lowered the 12-month target price on WiseTech Global (ASX:WTC) from $100 per share to $87.50, citing the fact that the stock is currently trading on its lowest EBITDA multiple since its IPO nearly 10 years ago.

- And in commodities, Gold has slipped 0.7% to be trading a shade over US$5000 per ounce, while silver has dropped 3.2% to 80 USD ounce. Crude Oil has remained flat at US$64.17 per barrel.

Interview Series

Watch our interview series to get exclusive insights and trading ideas. Open a Bell Direct account today.

_600_338.png)

_600_338.png)

-min_600_338.PNG)

-min_600_338.PNG)

_600_338.png)