Black Monday may have occurred almost 30 years ago but few have forgotten it.

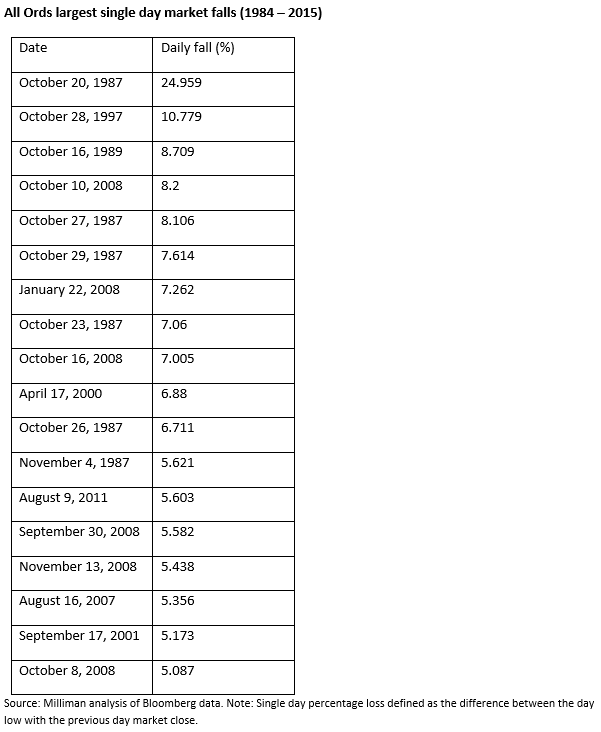

The Australian share market’s single day fall (our Black Tuesday) of almost 25% in October 1987 changed markets and still serves as a reminder of the potential magnitude of outlier events.

Such falls between trading periods – gap risks – are exceedingly rare but remain a real risk.

Stocks are naturally exposed to gap risks (a share may close at $5 and then open the following day at $4) but so too are many portfolios. For example, a 70:30 growth/defensive fund would post a 17.5% loss in the 1987 scenario.

It’s important that investors understand the magnitude and frequency of gap risk events if they are to judge whether to protect against them and, if so, which is the most efficient strategy to choose.

A rare event

Since 1984, the All Ordinaries Index has recorded just two periods of single day market losses greater than 10%. There were 18 days of single day market losses greater than 5% over a total of 7939 days representing 0.23 per cent of trading days.

It shows that significant market gap events are infrequent. Meanwhile, their size has been curtailed by new rules introduced by many global exchanges since 1987.

For example, if the S&P 500 drops past a 7% threshold, the market shuts down for 15 minutes. If it then drops past a 13% threshold, the market shuts down for another 15 minutes. If it then drops by 20%, the market shuts down for the rest of the day.

The Australian Securities Exchange implements similar circuit breakers on a discretionary basis.

Protection strategies

While gap events are rare, risk-averse investors who still want protection have several possible strategies to consider.

Reducing exposure to risky assets

Investors can reduce or eliminate their exposure to growth assets and raise their allocation to cash or risk-free bonds. Alternatively, they can invest in an insurance company guarantee or annuity.

Unfortunately, given the current market environment of historic low interest rates, these approaches are also likely to provide extremely low returns.

Options: a costly approach

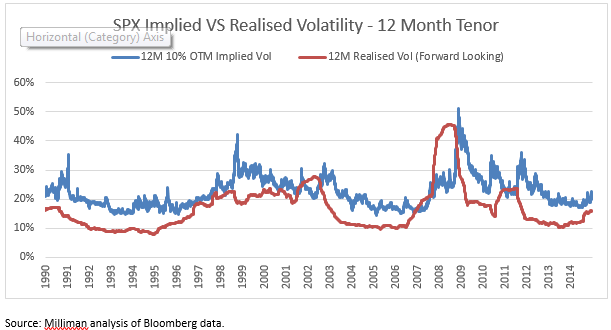

Option prices are typically quoted as implied volatility which usually trade at a premium to the realised volatility of the underlying security. In effect, option buyers pay option sellers an added premium to cover unexpected market risks including low probable events such as gap risk.

For example, the following graph shows the market implied volatility for 12 month “10% Out of The Money--” put options for the S&P 500 index. On average, for the entire history shown (1990-2014) implied volatility has been 2.95 percentage points greater than realised volatility. Since 2010, this implied volatility premium has averaged 4.20 percentage points greater than realised.

In pricing a 12 month 10% ‘Out of the Money’ put, this extra 3-4% implied volatility premium roughly equates to an added 100- 150 bps per annum cost of protection

Typically, funds attempt to reduce the high cost of put option premiums with spread trades or by purchasing low probability ‘tail risk’ options. While these strategies can reduce costs, they also only provide partial protection against gap events.

For example, while 20% ‘out of the money’ puts are relatively cheap compared to ‘at the money’ options, the option holder wouldn’t benefit unless the market fell by at least 20%. If the market fell by 25%, the investor would still absorb more than 80% of the total loss.

More complex option trading strategies can also be employed although these are more akin to discretionary bets which can’t fully protect against a gap event.

Systematic dynamic hedging: transparent and cost-effective

Dynamic exposure management via equity futures is a lower-cost risk management strategy than options, offering greater transparency and liquidity. Exchange-traded futures offer additional benefits including lower transaction costs, flexibility, scalability and daily cash settlement.

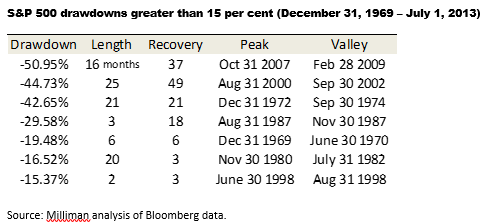

The strategy is particularly effective at protecting portfolios against more normal drawdowns which occur over longer periods – these are far more common than gap events as shown in the table tracking the S&P 500 below.

But while dynamic hedging is more efficient at managing typical market drawdowns over a period of time, the strategy does not explicitly guarantee protection against gap events. As outlined above, options provide gap risk protection, albeit the buyer of the option may be paying a significant premium to protect against extremely low probability gap events.

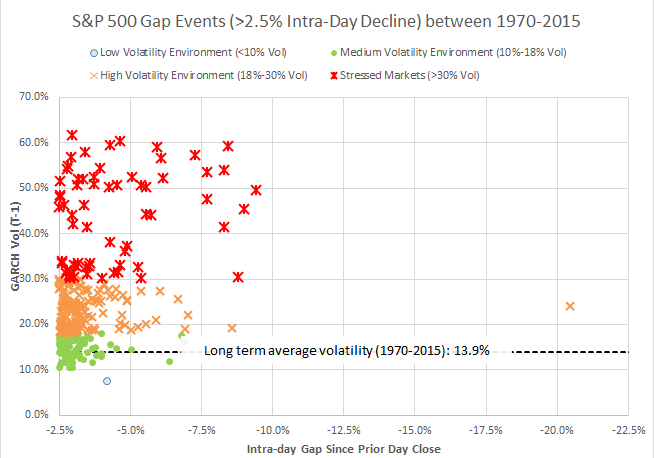

Further, depending upon the parameters used within the dynamic hedging strategy, risk associated with gap events can be mitigated. Because gap events often strike during periods of high volatility, strategies that incorporate managed volatility would have potentially lower exposure to risky assets during gap events.

The following table illustrates the level of volatility on the day before the S&P 500 posted a loss greater than 2.5%. The red ‘stressed markets’ indicators shows that the majority of negative gap events occurred in periods of higher than average volatility – periods when managed volatility strategies would have reduced those losses.

Source: Milliman analysis of Bloomberg data

A holistic approach: layering risk management strategies

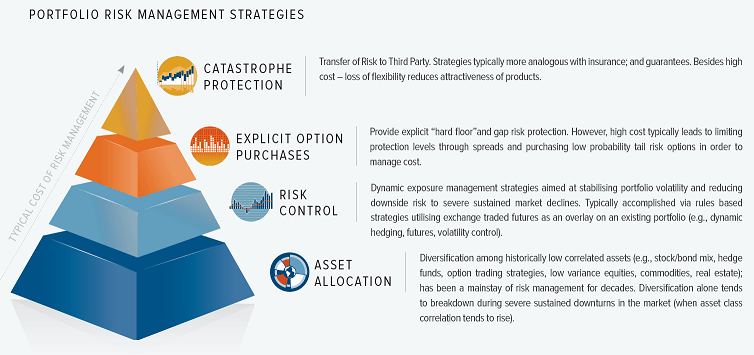

Portfolio diversification stands on the front-line of risk management. However, a more sophisticated and effective approach employs a range of strategies, including low-cost and transparent dynamic futures hedging providing the bulk of risk control.

Depending on an investor’s risk tolerance, further risk management strategies can be combined to tailor particular outcomes cost effectively. For example, lower-cost tail risk options can also provide extra hard floor protection to dynamic exposure management strategies.

In comparison to strategies that depend solely upon high-cost options for the bulk of risk management, a layered approach will be more predictable, scalable, and cost-effective.

This article has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.